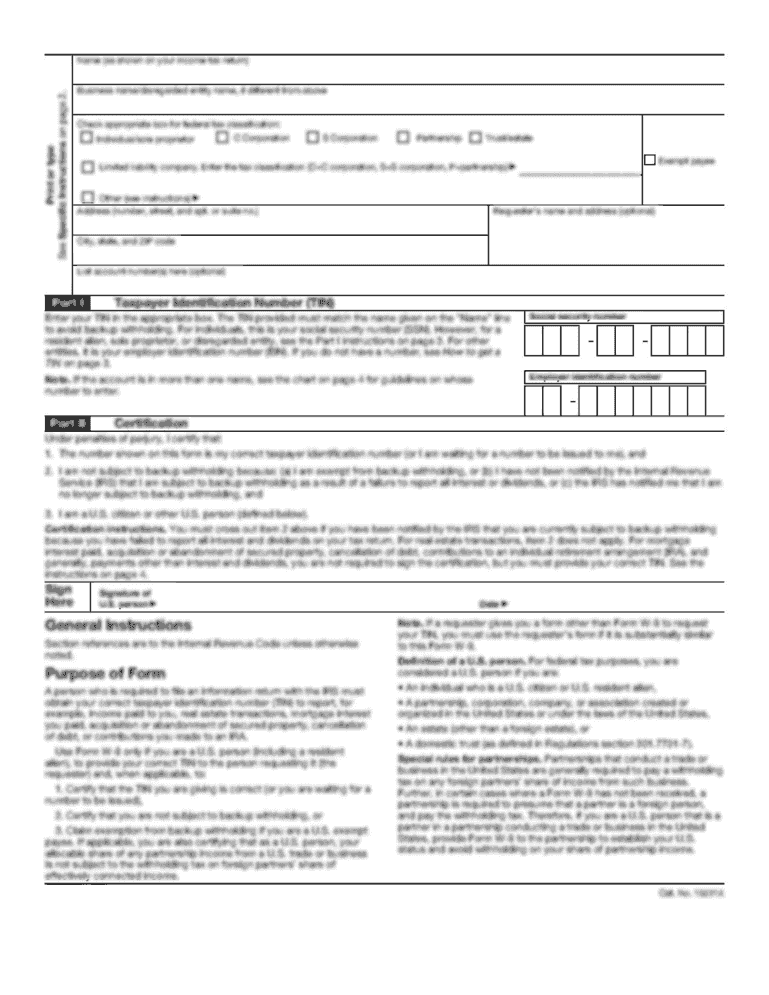

UK HMRC C81 2012-2024 free printable template

Show details

By completing this form you must not assume that your obligations are automatically met. Please ensure you do meet your obligations for pre-entry at import and for any retrospective claims for duty relief. Customs acceptance of your form C81 will not affect any possible civil penalty actions. Hmrc.gov.uk and look for C81 within the Search facility. Your rights and obligations Your Charter explains what you can expect from us and what we expect from you. For more information go to www....

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your c81 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your c81 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing c81 form online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit form declaration customs. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

How to fill out c81 form

How to fill out form declaration customs:

01

Gather all required documents and information, such as passport, flight details, and declaration form.

02

Ensure you have a clear understanding of the items you are required to declare, such as goods exceeding duty-free allowances or restricted items.

03

Fill in personal information accurately, including your name, address, and contact details.

04

Declare all items as required, providing detailed descriptions, quantity, and estimated value.

05

If applicable, provide supporting documentation or permits for any restricted or prohibited items.

06

Sign and date the form, confirming the accuracy of the information provided.

07

Submit the completed form to the customs officer upon arrival or departure.

Who needs form declaration customs:

01

Any individual traveling internationally, either arriving or departing, may need to fill out a form declaration customs.

02

This is applicable to both citizens and foreign visitors entering or leaving a country.

03

All passengers, including those on commercial flights, private jets, or cruise ships, might be required to present a completed form declaration customs to the customs authorities.

Fill form hmrc information : Try Risk Free

People Also Ask about c81 form

What is declaration for free entry of returned American products?

Can I fill out US customs form online?

What items need to be declared at customs?

What is the customs declaration form for returns?

Who must fill out a customs declaration form?

How do I fill out a customs declaration form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form declaration customs?

Form declaration customs is the process of legally declaring goods to a customs office when they enter or leave a country. This process is used to determine the duties and taxes that must be paid on the goods. The form used to declare goods can vary from country to country. This form typically includes information such as the type, quantity, and value of the goods in question.

Who is required to file form declaration customs?

Form Declaration Customs is typically required to be filed by importers or exporters who are bringing goods into or out of the United States. The specific requirements may vary depending on the type of goods being imported or exported and the country of origin or destination.

How to fill out form declaration customs?

1. Enter your name and contact information in the provided fields.

2. Enter the details of the goods you are importing into the country, including quantity, weight, value, and description.

3. Select the appropriate customs duties, taxes, and fees applicable to the goods.

4. Provide proof of origin documentation such as an invoice or bill of lading.

5. Sign and date the form.

What is the purpose of form declaration customs?

Form declaration customs is a process which is used to declare the value of goods that are being imported or exported from one country to another. It is used to determine the amount of taxes and duties to be paid on the goods, as well as to ensure that the goods meet the destination country’s customs regulations. It is also used to collect information about the goods for statistical purposes.

What information must be reported on form declaration customs?

Form Declaration Customs requires the following information to be reported:

-Name, address, and contact information of the importer

-Name, address, and contact information of the exporter

-Description of goods being imported

-Quantity and value of goods

-Country of origin and manufacturer of goods

-Mode of transportation used

-Harmonized System (HS) code

-Currency of payment

-Any applicable taxes or duties

When is the deadline to file form declaration customs in 2023?

The exact deadline for filing form declaration customs in 2023 will depend on the country and the type of goods being imported. It is best to contact your local customs office for the most up-to-date information.

What is the penalty for the late filing of form declaration customs?

The penalty for late filing of a customs declaration form can vary depending on the severity and amount of time past the due date. Generally, the penalty can range from a warning letter to a fine of up to $10,000.

Can I create an eSignature for the c81 form in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your form declaration customs right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I complete hmrc information on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your c81 amendment form, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

Can I edit export import hmrc on an Android device?

You can make any changes to PDF files, such as customs hmrc form, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

Fill out your c81 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hmrc Information is not the form you're looking for?Search for another form here.

Keywords relevant to datasheet lika c81 pdf form

Related to hmrc c81 form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.